8 mins | 2,644 words

This blog features a round-up of the key takeaways from each panel at this year’s AccelerateOTT. For the busy entrepreneur, if you’re looking to cut to the chase and get right to the valuable knowledge, click on the panel of interest below to get straight to the key insights.

Opening Fireside Chat | ScaleUp Panel | Keynote Fireside Chat | Tech Founder Panel | Investor Panel | Keynote Presentation

And so the day came and went on October 27, where over 1,000 budding and progressive entrepreneurs registered from Ottawa, across Canada, and internationally (including in 10 countries) to AccelerateOTT 2021! Through a randomly selected draw, we welcomed 50 AccelerateOTT’ers safely to Bayview Yards to equip themselves with powerful insight and knowledge from the in-person and digital stage, making the day a truly immersive hybrid event experience.

Hybrid events, the new norm

At the onset of the pandemic, businesses quickly adapted to virtual events as the new normal to get their content, programs and services to their audience. But as life returns to yet another new normal, a different type of event evolved—the hybrid event.

At the onset of the pandemic, businesses quickly adapted to virtual events as the new normal to get their content, programs and services to their audience. But as life returns to yet another new normal, a different type of event evolved—the hybrid event.

At Invest Ottawa, hybrid events not only allowed us to continue to deliver an impactful AccelerateOTT 2021 experience to enrich and accelerate the ventures of entrepreneurs at all stages, but opened the floor to connect and unite the entrepreneurial ecosystem across the globe to expand their knowledge transfer from world-class speakers like CBC’s Dragons’ Den Manjit Minhas and CEO and Founder of BroadbandTV Corp, Shahrzad Rafati. Both in-person and online entrepreneurs received an equitable and seamless experience—a win-win for all.

Were attendees engaged during the event? Yes. Were there networking opportunities? Yes. Were there exhibition booths for sponsors? Yes! In fact, before hybrid events existed, it wasn’t uncommon for live events to host technological features such as event apps for chatting, networking, and polling.

And with Ottawa having the highest concentration of tech talent in its labour force in North America and ranking top 10 overall as one of the only two Canadian cities, it’s common sense that the City would be a launchpad for innovation and entrepreneurship, being the ideal location to host top-notch hybrid events. AccelerateOTT was exactly that—a high calibre hybrid event, utilizing the Hopin event platform in combination with homebred video production equipment, secured from Ottawa’s very own Ross Video, to provide a spectacular production.

From the stage and airwaves

The day was filled with actionable, thought-provoking content. Changemakers and groundbreakers led from the stage and airwaves, pushing through the She-Cession and sharing the secrets to success with lessons learned from the trials and tribulations of their entrepreneurial journeys.

success with lessons learned from the trials and tribulations of their entrepreneurial journeys.

From inspirational insight on resilience, client attraction, revenue generation, talent attraction and investment acquisition to actionable opportunities to create a more diverse, equitable and inclusive entrepreneurship ecosystem, AccelerateOTT 2021 had something for everyone to walk away with and make their next big-money moves.

That’s why we are sharing the top takeaways of the day for each panel session for you to take in and digest the valuable golden nuggets of wisdom each discussion brought to our AccelerateOTT’ers. The content was so rich that we just had to share!

Opening Fireside Chat

Esosa Johnson, Co-Founder of Black Women Talk Tech

Shavonne Hasfal-McIntosh, Director of Diversity, Equity & Inclusion at Wealthsimple, Invest Ottawa Board Member and host of Invested In Our New Reality, Invest Ottawa’s pandemic-born podcast.

Moderator: Manjula Selvarajah, Journalist, Producer and Syndicated National Tech Columnist This opening fireside chat kickstarted AccelerateOTT and woke up the audience with real talk about the challenges and opportunities emerging from the She-Cession, the disproportionate impact of the pandemic on women (especially in marginalized communities), and how we call can drive change.

The chat was buzzing from the stellar content brought forward, which ignited the spark for AccelerateOTT 2021. Here is what everyone can agree on for the top takeaways from an empowering session:

- It’s imperative to check on biases at an individual level to see change at a collective level to help overcome systemic challenges.

- A top-down approach of having more women in investment and women on boards will have more women funded. But, ultimately, an ‘all hands on deck’ approach, including men and women in investment and power positions, is needed to disrupt the systems drastically and put more capital in the hands of women founders.

- Find your community of support and entrepreneurial circle to tap into for resources and opportunities. The virtual environment has opened doors for entrepreneurs from all walks of life to expand their networks.

- Pitching is just part of the process. Pitch as many times as you can to get feedback and suggestions to help you build a persuasive pitch.

- Fundraising can be daunting, but getting access through incubator and accelerator programs can assist with raising capital and access to mentors and advisors to support your business.

“Talent is everywhere but opportunity isn’t…” @BWTalkTech @Invest_Ottawa #accelerateott pic.twitter.com/7DHr32umi6

— Karla Briones (@HolaKarla) October 27, 2021

Strong intro to a great talk #AccelerateOTT – Until the lion learns to write, the story will always be written by the hunter. @SosaSpeaks @manjaselva @PinkRobotTO #womenentrepreneurs #womenfounders RvC Worldwide #storythroughnumbers #iterateandinnovate @…https://t.co/G3KAoTHgET

— Cindy Guyon (@LinkingVentures) October 27, 2021

ScaleUp Panel

Bethany Deshpande, Founder and CEO, SomaDetect

Heather Ward, Co-Founder, President and CCO, Hyperion Global

Bobbie Racette, Founder and CEO, Virtual Gurus

Moderator: Sonya Shorey, Vice President of Strategy, Marketing and Communications, Invest Ottawa, Bayview Yards and Area X.O

This next panel was all about the real talk with a vulnerable and honest discussion about the challenges of building diverse tech ventures. Built on the foundation of resilience, three changemakers shared inspiration and actionable insight on client attraction, revenue generation, talent attraction and investment acquisition—with the mindset of helping Canada and the world build back better.

There was a lot to unpack in this short session, but here’s what you need to know:

- Validate, derisk, and build traction where you can in the early stages through the use of accelerator programs.

- Be resilient to getting a lot of ‘nos’ when pitching to land funding. Learn from each pitch, be persistent and take it as an opportunity to pivot when necessary.

- In your business’s early stages, shaping and refining your story can help set you up for success when attracting funders. Take the time to shape your brand and personal story. Success in fundraising comes from telling a great story that captures the heart and mind.

- Culture is key. The clearer you are with your mission and vision, the better chance you have to attract the right people and retain talent.

- Don’t change who you are. Believe in yourself. Be bold and be brave. The no’s will be easier to handle when you believe in yourself and your business.

- When looking to scale, find alignment with partners. Specifically for exporting strategies, find global leaders in your space to build relationships on a local level.

“One thing I learned is do not change who you are. Believe in yourself and be you. Be bold and brave. ” – @Bobbie_Racette, Founder and CEO @virtual_gurus #AccelerateOTT ???????????????? pic.twitter.com/TyX1bs875m

— AccelerateOTT (@AccelerateOTT) October 27, 2021

“There’s just so much learning and all that adds to the fundraising and entrepreneurial journey.” – Bethany Deshpande, Founder and CEO @SomaDetect at #AccelerateOTT pic.twitter.com/IAb1llsQJ6

— AccelerateOTT (@AccelerateOTT) October 27, 2021

Keynote Fireside Chat

Amber Mac, Keynote Speaker, Bestselling Author, TV Host & Tech Expert

Shahrzad Rafati, Founder & CEO at BroadbandTV Corp (BBTV)

The path from start to IPO is quite the journey. Shahrzad Rafati delivered a robust discussion to help you unpack the way towards IPO, encouraging everyone to reach IPO status.

There were so many quality nuggets of shared secrets to success from Shahrzad. We selected the top tidbits you should know about:

- Don’t just focus on your financial bottom line, but rather your Quadruple Bottom Line. Setting short and long term goals for each of your bottom lines will contribute to a healthy, impactful, and successful organization:

- People

- Social

- Environmental

- Financial

- Empathy is at the core of great leadership and creating an inclusive workplace. Listening is crucial to understanding a variety of perspectives that represent and impact businesses.

- To be successful long term, you must take care of your physical and mental health. The pandemic has exacerbated the need for many entrepreneurs to prioritize well-being.

- A business’s value does not equate to its market cap. Build a solid company with strong results and fundamentals, and the market and investors will eventually catch on.

- Go after large pools of opportunity. Choose to solve a large problem as it requires the same amount of work and will create a larger impact.

- For Canadian tech companies to scale, a larger pool of investors that understand the tech ecosystem is necessary.

Fabulous conversation between @ambermac & @shahrzadrafati. @BBTV CEO Shahrzad Rafati made a massively important point — our leading global tech firms can only grow from ???????? if we build an investment sector that understands & supports these companies. Thx #AccelerateOTT. #cdnpoli https://t.co/640KV2ju4S

— Senator Colin Deacon (@colindeacon) October 27, 2021

“You need to take care of your physical & mental health. If you have too much on the go, take a minute. Go after large pools of opportunity. Follow your passion. There are no shortcuts. Stay committed.”

????@shahrzadrafati shares some final advice to the #AccelerateOTT audience. pic.twitter.com/BAqs3Ee4w1

— AccelerateOTT (@AccelerateOTT) October 27, 2021

Tech Founder Panel

Rachel Bartholomew, Founder & CEO, Hyivy Health

Julie MacDonell, Co-Founder and CEO, Heirlume; inaugural SheBoot Pitch Competition Winner

Sem Ponnambalam, Co-Founder and President, xahive

Jana Rieger, Founder and CEO, True Angle

Moderator: Julia Elvidge, SheBoot Co-Founder, High Tech Advisor, Investor, Co-Founder and Former President, Chipworks

AccelerateOTT’s tech founder panel was all about fueling the entrepreneurial fire with actionable insight to help scale up, generate revenue and customers, and fund your business venture. Five incredible founders shared their stories of how ecosystems are supporting tech founders in their journeys. And the message was clear here:

- Women-led companies would benefit more from government funding allocated directly to founders within accelerators.

- Women founders and owners want fewer learnings of business foundations within accelerator programs and more nitty-gritty details of running a business to level up.

If you’re in the entrepreneurial tech trenches looking to tackle the burning questions that keep you up at night, then here’s what you need to know from this inspirational session:

- Timing is key for choosing the right accelerators. Be strategic about which accelerator you select through the different phases of your company and find the one that fits your stage.

- When seeking unexpected investment:

- Go coast to coast. East Coast versus West Coast has a different approach to valuation.

- Be bold in your ask and know what you want

- Know your terminology and put together your due diligence package so you’re prepared

- If you’re in the early investing stage, focus on strategic angels that align with your mission and vision. Angels are often the investors who will support you as they’ve been in your shoes before.

- From a startup perspective, ensure you have the right support systems. Have your legal and financial contacts in order. And once you start scaling, use a bank that can support you internationally.

- Get help early on in your venture by exploring your ecosystem and network. Often there are a wealth of resources waiting to be discovered, including knowledge of accelerators.

#AccelerateOTT Tech Founder panel rocking now. ‘Find the accelerator that fits your stage’ Julie MacDonell Moderated by #SheBoot Founder and @CapitalAngels Board Member @Julia_Elvidge #YOW #OTT @Invest_Ottawa @sshorey pic.twitter.com/w7FziiEv81

— ???????? mobilizing investment in Canada’s capital (@SuzanneMGrant) October 27, 2021

A common theme for our panelists: timing is everything. #AccelerateOTT ???? pic.twitter.com/YHLkI1orvh

— AccelerateOTT (@AccelerateOTT) October 27, 2021

Investor Panel

Janet Bannister, Managing Partner of Real Ventures

Christophe Bourque, General Partner at White Star Capital

Candice Matthews Brackeen, CEO of Lightship Foundation, General Partner at Lightship Capital

Judy Fairburn, Co-Founder and Co-CEO of The 51

Moderator: Jennifer Francis, Chair, Capital Angel Network, SheBoot Co-Founder, Investor and Tech Executive

This panel was armed with actionable takeaways for aspiring entrepreneurs who are looking to land investment from VCs. Four experts shared the best-kept secrets in the investment world, and we are delighted to share with you the top insights to accelerate your venture:

- Geography is no longer a barrier. The pandemic has propelled investors to do their due diligence and investments remotely.

- It’s easier for investors to invest in a movie than a photograph. Getting in front of investors in your early-stage and developing a relationship is key so investors can get to know you and your company.

- Be prepared when you’re ready to fundraise. Show you’re in control of your business, have your story, know your data and KPIs, and have those up on the screen. Show investors and help them build conviction.

- Have a consolidated and tight process when you’re ready to fundraise. Having more VCs in your pipeline prepared to invest simultaneously will allow you to select investments within the same round.

- Focus your pitch on storytelling, including your hardships. Sharing your passion and why along with your struggles, gives investors confidence while showing your resilience and perseverance.

- Build your team for the future. Investors are looking to back people and teams that can successfully execute a business plan.

“Female founders need someone to look up to.” @jebannister Managing Partner @realventures at #AccelerateOTT ???? pic.twitter.com/3tZNzbRTII

— AccelerateOTT (@AccelerateOTT) October 27, 2021

Keynote Presentation with CBC’s Dragons’ Den Manjit Minhas

With Susan Richards, Founder and Managing Partner, numbercrunch Inc.; Co-Chair of the Board, Invest Ottawa and Bayview Yards

The keynote presentation by Manjit Minhas from CBC’s Dragons’ Den came in hot. It was the perfect way to end AccelerateOTT 2021 with a fire discussion on the secrets of success to bring any business next level, especially in the Den. Notes were taken. The chat was buzzing. Advice was given. And here’s the many gems that Manjit generously shared to help the entrepreneurial community scale with success:

- Understand and know your industry inside and out to be best equipped for success. By being prepared and well-researched in your industry, you can be the go-to source of knowledge for your business.

- In terms of scaling success, learn to say ‘no’ more than you say ‘yes,’ so that you can stick to your vision and stay the course for your scaling strategy.

- Make your public relations strategy a priority as part of your customer acquisition and marketing strategy. Your story is one of the major components of success with investors.

- Educate your customers on your product. Through education, customers can develop a relationship with your brand.

- Know who your customers are and what platforms best you can reach them.

- Marketing for customers also means marketing for talent. As you brand your company to find customers, keep in mind that you are also branding your company to find talent.

- Know your financials and numbers. Ideas are great, but revenue and understanding your costs are key.

- Investors want to invest in people—people who are driven, coachable, accountable, responsible, and open to iterating their products and ideas for the needs of their customers.

- An outstanding pitch is:

- Concise

- Only a couple of minutes

- Answers the basic questions

- Addresses the “Who, What, Where, When, Why, and How”

- Be a mentor. Give back to your community by sharing your skills with all walks of life that can benefit from your knowledge for their success.

- Invest in yourself. Mental and physical health is paramount to your success, so know your non-negotiables and stick to them.

“Innovation is not exclusive to tech”. Inspiring insights from @cbcdragon @manjitminhas on innovating at Minhas Breweries in conversation with @iSunsun @Invest_Ottawa @Bayview_Yards ????#AccelerateOTT pic.twitter.com/ldBHzE6KlO

— Claudio Rojas (@claudio__rojas) October 27, 2021

“All of the things that make me stand out are advantages not disadvantages. I learned to use that fuel and use that as fire.” – @manjitminhas ???????? pic.twitter.com/d5dlD51HLo

— AccelerateOTT (@AccelerateOTT) October 27, 2021

Be bold. Be brave. Tell a compelling story.

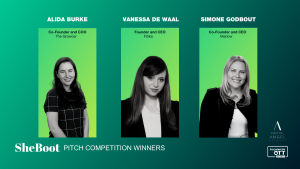

The reoccurring themes of the day. But also what our second cohort of the SheBoot Pitch Competition put into practice at the pitch competition. Hundreds of online participants cheered as ten remarkable women founders competed for a total of $200,000 in investment from 20 local women angels.

It was a tough decision for both judges and attendees voting for Crowd Favourite, but choices had to be made. The winners were announced:

- Alida Burke, Co-founder and COO of Growcer, an Ottawa-based social enterprise addressing food security and empowering communities in any climate, from the Arctic to the desert, to grow fresh, hyper-local produce year-round through its hydroponic modular farms in purpose-built shipping containers: Top prize winner with $150,000 in investment.

- Vanessa de Waal, Founder and CEO, Flöka, an Ottawa-based company that helps lifestyle-focused practitioners scale data-driven, preventative care: Second prize winner with $50,000 in investment.

- Simone Godbout, Co-founder and CEO, and Nadia Ladak, Co-founder and COO, of Marlow, a company that designs and sells menstrual products and lubricated tampons on a subscription basis through an e-commerce channel: Crowd Favorite award winner with an opportunity to pitch the Capital Angel Network.

And there you have it. A ground-breaking day for a hybrid version AccelerateOTT 2021 packed with the most actionable insight and something for everyone to put to work right away.

Be sure to stay connected with us by becoming part of our vibrant entrepreneurial community. You’ll be the first to know about International Women’s Week 2022 along with your finger on the pulse of entrepreneur news, opportunities and resources.