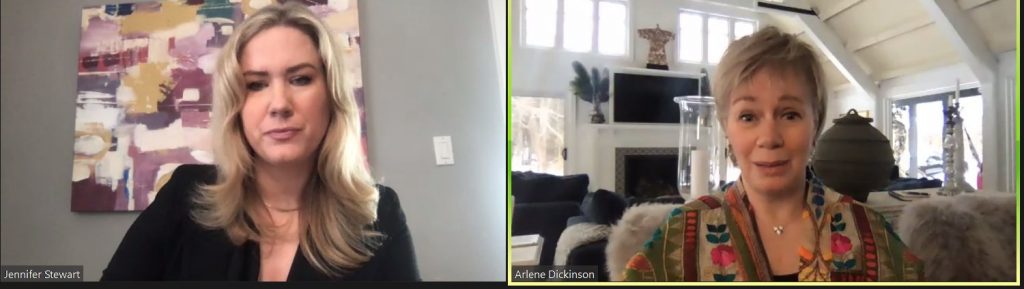

Jennifer Stewart and Arlene Dickinson on March 2nd during the Womxn Angel Investor Breakfast.

7.5 mins | 1539 words

By: Jennifer Campbell

“It’s important for women to do it because men aren’t.” So said venture capitalist Arlene Dickinson about investing in women-led businesses. She was speaking at the third annual — this time virtual — International Womxn’s Week Angel Breakfast, an event that addresses the issue of underfunding for female founders.

“We have to support each other,” the straight-talking best-selling author and star of CBC’s hit TV show, Dragon’s Den told Jennifer Stewart, president and CEO of Syntax Strategic, who interviewed her by Zoom. “By investing in another woman, you’re actually giving them the confidence and the capital they need to succeed. A lot of the capital markets are reverting back to old models so it’s very important that women invest in women. You’d be surprised how it can make such a difference in the future success of their business.”

Dickinson was the breakfast’s keynote speaker, which also featured a panel of founders and funders who spoke about their experiences, and an update from the creators of SheBoot, a six-week bootcamp, which prepares women founders to pitch their business and secure investment. It launched in the fall of 2020 and is now accepting applications for this year’s program.

The breakfast event came at a time when investment in women-owned business is especially dire, thanks in part of the COVID-19 pandemic. Venture capital funding to women in 2020 was down by 27 percent and women’s share of dollars has gone from 2.8 percent — an already very small number — to 2.3 percent.

Dickinson’s advice for women hoping to follow her path and become one of Canada’s top CEOs was to stick with it and be true to yourself.

“It takes a long time to create success,” she said. “When I was just starting out, there weren’t a lot of role models and women to look up to. My father taught me I could do anything I needed to do if I just believed in myself. For me, even on [Dragon’s Den] when I was the only female, it was trying to represent what I believed and that, of course, came from a female perspective. You are a female, you’ll come out that way. When you stand up for yourself, you’re standing up for all women.”

When she’s considering pitches, she looks for good ideas and good leaders. That has resulted in the majority of her fund’s portfolio’s companies being owned by women.

“If you start with no bias, you will win,” she advises would-be investors. “If you start with a bias that says it has to be a man, an experienced entrepreneur or people who have done it before, you won’t get to women because they’re just getting into this. I would try to erase bias.”

The leaders Dickinson looks for are people who are genuine, authentic and honest.

“It’s about both of us in this journey together,” she said. “If you’re pitching to someone, don’t be afraid to talk about the mistakes, but don’t focus on them.”

For first-time investors, she suggests invest because you know in your gut the pitch is a good idea and because you really believe in founders’ ability. It’s important to support family and friends, but investing in them isn’t the best idea because we’re sometimes afraid to tell them their idea isn’t great. She suggests being really clear on the rules, stating what you want from the investment and making sure the money you’re investing is money you can lose because investments are risky.

Dickinson told of her first angel investment, many years ago when $30,000 was a lot of money to her. She had an employee who wanted to start a travel adventure company in Thailand. With her investment, it became one of the most successful in the country.

“It was just a real joy,” she said. “When he paid me back that money, I remember thinking that money is what got him going and it was worth every risk I could think of.”

The moral of the story? Even a small amount of money is everything to someone launching a business.

Asked if she’d recommend using an advisory team when making an investment, she said it depends on the deal.

“If you’re making a $10,000 deal, you don’t want to spend $10,000 on support,” she said. “Educate yourself. Learn about it, take the time. Many of these agreements you can learn yourself. It’s not as complex as you think. But if it’s six figures or money that’s really important, absolutely rely on advisers.”

Looking more broadly at how Canada can compete with the rest of the world, Dickinson said there’s work to be done, and that Canadians, who are generally risk-averse, need to recognize that supporting entrepreneurs and elevating the ones who are having some success is essential.

“The nation needs to have more growth capital,” she said. “We need to focus on helping private equity. When I raised my fund, it was very difficult and I’m not unknown. I can’t imagine how difficult it would be others and that shouldn’t be the case. We need to be more risk-friendly with first-time fund managers, and female first-time fund managers in particular, and we need to educate and change the deep bias that exists in the financial sector on investing in women in general.”

Dickinson said for her part, she’d like to be remembered as someone who “genuinely wanted to make a difference in helping entrepreneurs in Canada succeed,” especially in the agriculture and health sectors, on which her fund is focused. She invests in the last mile of commercialization, something Canada is often criticized for not doing.

“We’re really good at shipping our [raw] products all over the world,” she said, but not good at refining or processing them into packaged goods for the consumer market. “I could not understand why we weren’t getting the majority of the margin from them. We do agriculture and health through R&D and innovation, but we’re not leveraging that expertise into creating packaged goods or products that countries around the world can buy. Access to good food and good health — these are macro-economic issues that need to be addressed. Canada is in such a great place to be able to help people eat better.”

Following Stewart’s interview with Dickinson, Julia Elvidge, co-founder of SheBoot, hosted a panel of Ottawa-area founders and funders. Two — Audrey Bond, CEO and founder of Vaultt.com, and Heather Ward, president of Hyperion Global Energy — have been recipients of Capital Angel Network funding. And two — Debbie Weinstein of LaBarge Weinstein LLP, and Sandra Ng, vice-president of Tesceleration Investments — are Capital Angel Network investors.

Panel discussion

The network imparted some good news through board chair Jennifer Francis: In three years, it has grown its number of women angels from five percent to 20 percent and it has funded 11 women-led companies over the same period.

Weinstein spoke about how angel investing has enriched her career. Over the past 25 years, she’s made between 30 and 40 investments.

“I get to see a founder on Day 1 and I get to go on a journey with him or her, from Day 1 to sale or IPO. And I get to do that [several] times in my career,” she says. “Instead of being a very small part of the technology industry, it’s allowed me to be at the centre of it.”

Elvidge said that’s why she’s an advisor at Invest Ottawa. “I meet these incredible women, like Audrey and Heather, early on in their careers and see how it develops and it’s so much fun.”

Sandra Ng was recently featured on the Power of Why Podcast. Listen now to her interview with Naomi Haile, Chart a Mission-Driven Path and Grow Wealth – For Yourself, and Your Community.

Ng said angel investing for her is a merging of two passions — “making money and making a difference.”

Ward, whose company converts waste CO2 emissions into profitable materials, or “turns dirty air into dollars,” said her funding journey has been challenging as her endeavour requires a lot of capital, but she’s found good financial support and mentorship from woman funders.

Bond, whose company offers a collaborative patient- and family-centric platform for secure information management and communication between care-givers, raised $500,000 in a year.

“When we talk about angels, I have to say, they truly, truly are angels that jump in and help founders start businesses that probably would not have been started without their assistance,” said Bond, who was SheBoot pitch-prize winner.

Asked for three words to describe the finds of investors they look for, Ward said, “impact, smart-money and network; Bond said, “belief, open and trust.”

Asked what they look for in founders, Ng said “integrity and grit” while Weinstein said “integrity, values and transparency.”

In summing up the morning, Francis gave an overview of the Capital Angel Network, whose makeup is 20 percent women, but the group is aiming to up that to 50 percent. The network includes 50 Ottawa area angels who have invested more than 35 million in Ottawa since 2009.

Francis summed up the spirit of the morning by sharing a convincing fact, which is that women investors earn higher rates of return than men. There’s also some evidence that, in aggregate, VC-funded women-led firms outperform their male counterparts.

Next steps

If you’re interested in learning more about what it takes to be an angel investor and how you can get involved with the Capital Angel Network or SheBoot, send an email to Julie Elvidge at [email protected].